Proposition 19 | Table of Contents

California Proposition 19 (CA Prop 19)

Proposition 19 saves those who inherit California real property thousands of dollars (or substantially more) per year in property taxes by eliminating the requirement for a reassessment of your home’s value. Your property tax bill is calculated as a percentage of the assessed value. If your home has been in your family for a long time, then the assessed value is probably quite a bit lower than the current fair-market value. This is because the amount of a home’s assessed value is not allowed to increase more than 1% per year due to Proposition 13.

Proposition 13: A Leading Factor in Your Property’s Tax Bill

, except when there is a change of ownership. Typically, a change of ownership triggers the county assessor’s office to determine the fair-market valuefffefff

What Is Proposition 19?

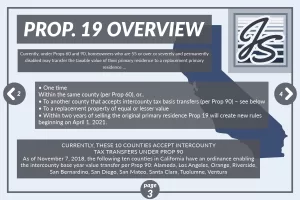

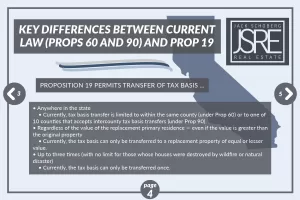

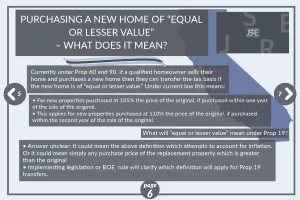

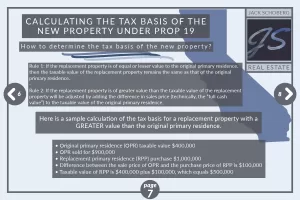

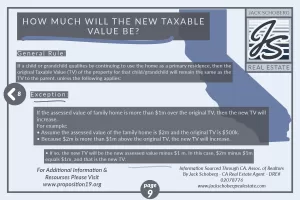

In short, it is a real estate property tax base transfer to keep the previous tax assessment and avoid reassessment after a real estate transfer. Usually, the transfer must be parents to children or grandparents to grandchildren, but there may be a few limited other qualifying circumstances, too. To expand on the question, please feel welcome to view a complete summary of how Proposition 19 works in the slides posted below. For additional details, property tax calculators, example scenarios, and more, please visit Proposition19.org and https://www.boe.ca.gov/prop19/

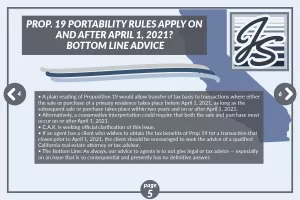

When did the proposition become effective?

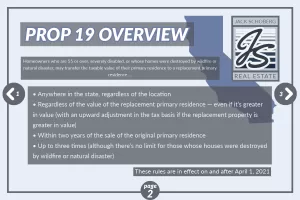

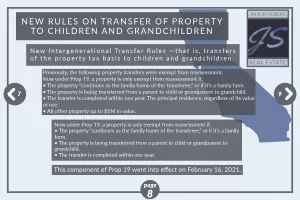

Proposition 19 was voter-approved on November 3, 2020, and became effective on December 16, 2020, with the changes to the parent-child and the grandparent-grandchild exclusion becoming operative on February 16, 2021. Finally, the base year value transfer provisions of Proposition 19 became operative on April 1, 2021.

Proposition 19: Slide Deck Summary

Contact Jack Schoberg with any questions or for immediate assistance

For immediate assistance or to discuss any real estate concerns, please contact Jack Schoberg at 310-933-2376 (call/text) or jack@jackschobergrealestate.com

Also, contact us to learn how you can receive thousands of dollars in cash back on your next real estate transaction!

Share This Post On Your Preferred Social Accounts

Share this post to help a friend save on their next real estate transaction or to help keep others updated on California real estate matters

For those considering how Proposition 19 might affect their financial future, it may also be beneficial to consult with financial advisors. Understanding how the tax structure could influence estate planning is crucial for making informed decisions. By incorporating Prop 19 into their long-term financial strategy, families can ensure they are maximizing their benefits and protecting their assets.

Understanding the new proposition is crucial for homeowners and heirs alike. Avoiding property tax reassessments directly impacts the financial landscape for many families. For example, consider a family inheriting a property once valued at $500,000. A reassessment could increase their annual tax burden significantly. However, with the provisions of Prop 19 in place, they can maintain the previous tax rate, potentially saving thousands each year.

Moreover, there are additional benefits to those over 55 years old, severely disabled individuals, and victims of natural disasters. For these groups, the ability to transfer their property tax base to a new residence becomes invaluable. This allows them to move without the burden of increased property taxes, facilitating their relocation to more suitable living conditions. A recent case showed a retired couple moving from a large family home to a smaller, more manageable apartment, saving them considerable amounts in taxes thanks to Prop 19.

In light of these changes, it is essential to understand how and when to utilize these benefits. Engaging with local real estate experts can provide insights and personalized strategies tailored to individual circumstances. For instance, Jack Schoberg, an expert in California real estate, offers consultations that can help potential heirs navigate the complexities of inheriting property under the newly passed proposition.

After the effective date of Prop 19, many California residents began seeing significant changes in how property taxes were calculated. The new rules fostered a sense of security among families, knowing they could keep their inherited properties without the fear of escalating tax bills. This was especially evident during tax season when many beneficiaries expressed relief at avoiding the anticipated tax reassessments.

Furthermore, staying updated on changes and nuances in California real estate law is vital. As legislation continues to evolve, the implications on taxation and property ownership can shift, impacting residents differently. Joining community forums or subscribing to real estate newsletters can keep homeowners informed about their rights and options regarding Prop 19.

Lastly, community outreach efforts are underway to educate residents about the inheritance and property tax benefits. Local workshops and seminars are being organized to provide comprehensive guidance and resources for families looking to navigate the complexities of tax reassessments and property inheritance. These events not only empower individuals with knowledge but also foster a sense of community and support among homeowners.