Jack Schoberg Real Estate

Avoid Capital Gains Tax When Selling

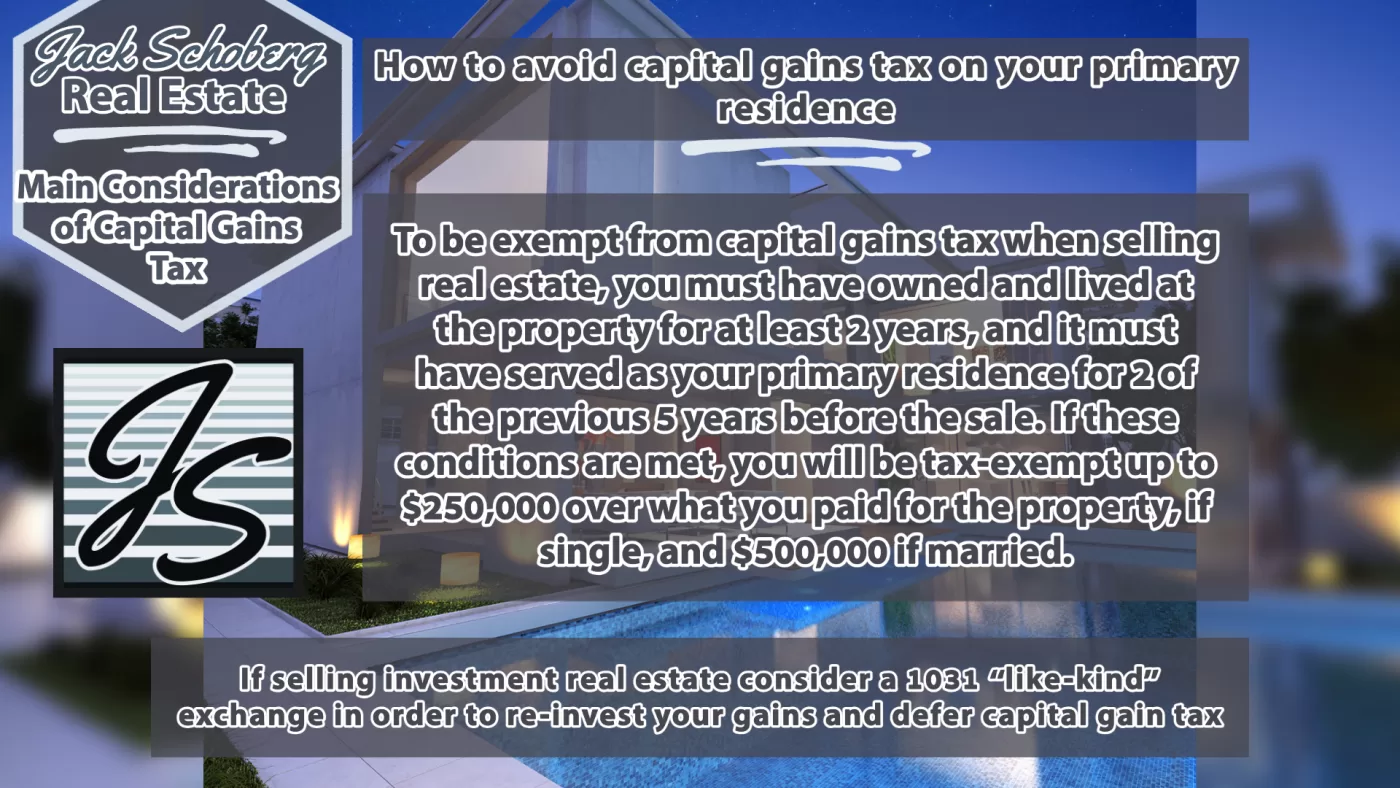

When selling your primary residence there are just a few considerations to remember to avoid capital gains tax, which could be required if selling for a gain. The main consideration is that the property must have served as your primary residence for at least 2 years, if you owned the property longer than 5 years it must have served as your primary residence for 2 of the last 5 years. For a single person, up to $250,000 over what the property was purchased for is exempt from capital gains tax, and for a married couple it’s $500,000.

Avoid Capital Gains Tax When Selling Investment Property

When selling commercial or investment property, avoid capital gains tax by deferring it with a 1031 Like-Kind Exchange. A 1031 exchange is a type of tax-deferred exchange that comes from Section 1031 of the Internal Revenue Code (IRC) that allows real estate investors to defer capital gains taxes when selling one investment property for another. This tax-deferred exchange involves using the proceeds from the sale of the relinquished property to acquire another like-kind replacement property of equal or greater value.

How do I perform a 1031 Exchange? What are the Steps Involved?

To perform a 1031 exchange you will need to enlist the services of a Qualified Intermediary to help facilitate the transaction. The QI will secure the proceeds from the initial sale of your original property while you locate a suitable replacement property. Once a replacement property is selected, and a purchase agreement has been made, the QI will apply your untaxed proceeds from your sale to your replacement property. Once the initial property is relinquished (sold), you have 45 days to identify the replacement property(s), followed by 180 days to close the like-kind property(s). If any of these conditions aren’t met, then the exchange would be considered failed and you would be liable for taxes on the relinquished property.